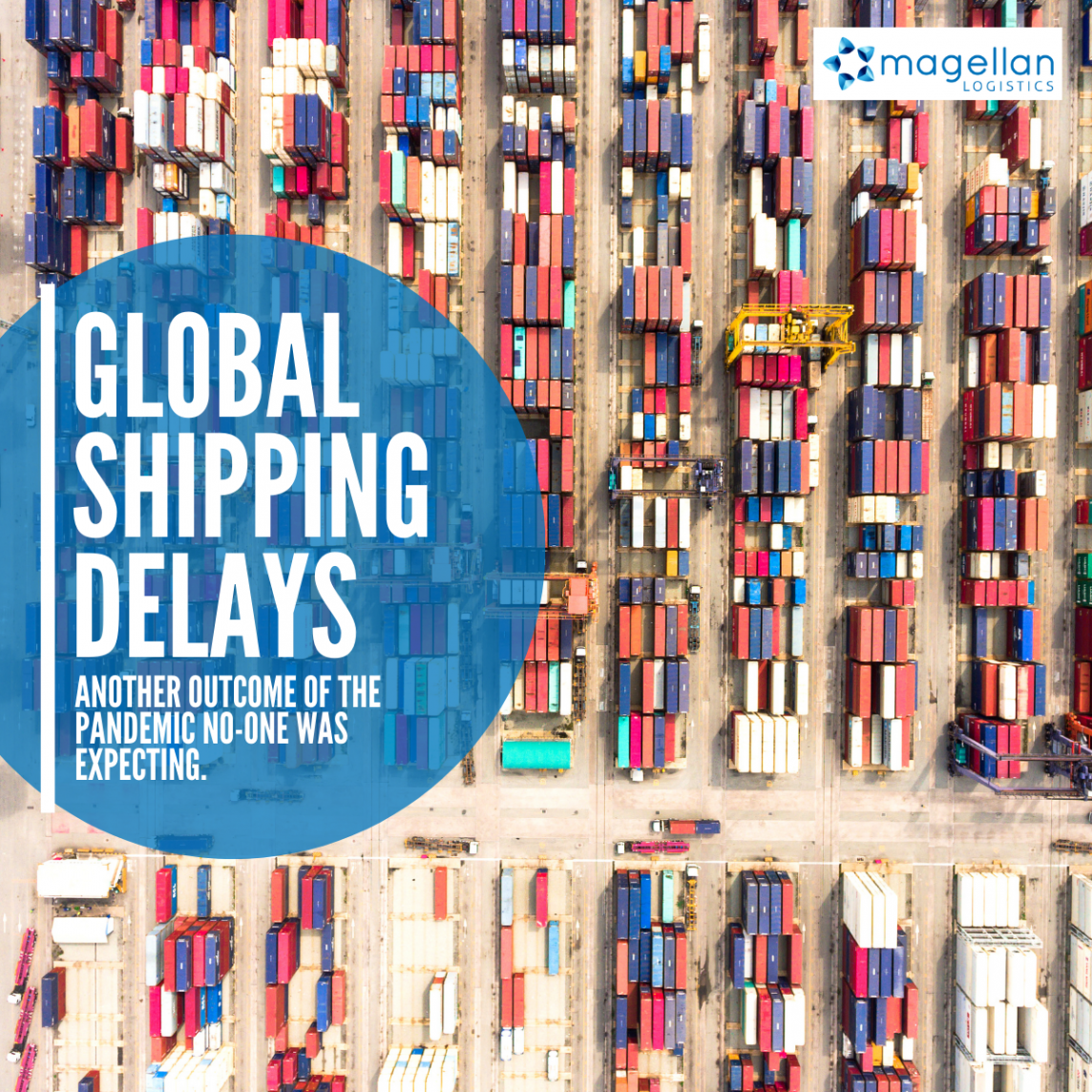

Unexpected consumer demand is seeing record freight volumes moving through ports all over the world causing global shipping delays. The downstream impacts of the demand spike are severe port congestion, a tripling of freight rates, equipment shortages and high-priced goods. This culminates in a frustrating level of delays, schedule changes and eroded margins. That’s the nature of shipping now. A single Google search produced 14 articles published globally on shipping delays over two weeks.

Quoted in The New York Times, Lars Mikael Jensen, head of Global Ocean Network at A.P. Moller-Maersk, said, “I’ve never seen anything like this. All the links in the supply chains are stretched. The ships, the trucks, the warehouses.”

Cause and compounded effect in a complex system. As Neil Gaiman said, “When a butterfly flaps its wings in the Amazonian Jungle, a storm ravages half of Europe”. Or in this case, an empty container park in Melbourne reaches capacity, a soybean shipment from Chicago waits weeks for an export slot.

But did you know the current chaos can be traced back to the GFC?

Here’s how it started.

In the lead up to the GFC, large shipping lines invested heavily in their businesses with the expectation of continued growth in global trade. The financial crisis and slow consumer demand lead to an oversupply of space and low sea freight rates for years to come, decimating the shipping industry.

Not to be caught a second time, when the Coronvirus emerged from China in early 2020 and the Chinese Government closed factories, shipping lines were quick to react, cutting services and idling vessels in anticipation of another global financial downturn.

But something unexpected happened. First, a surge in demand for PPE enabled Chinese factories to ramp up production to supply businesses that had pivoted their models to survive the pandemic. A spike in demand for consumer products quickly followed. As people began working from home and were prevented from travelling, dining out and attending sporting events and concerts, they began to spend on groceries, exercise equipment, office furniture, electronics, and homewares. Bricks and mortar retail might have been slow, but e-commerce was having its moment as people socially-distanced and spent their money online like their lives depended on it.

No one was prepared for it.

Almost overnight, a demand-side problem became a supply-side problem. Production in Chinese factories came back into full force in the second half of 2020, generating enormous demand for shipping space.

Most air freight is carried in the belly-space of passenger aircraft. With the grounding of fleets and service restrictions, air freight slots are all but non-existent in some sectors. The impact of this made air freight rates uneconomic for many importers putting more pressure on sea freight volumes.

Importers wary of the uncertain market conditions and fearful of stockouts began to order in higher quantities compounding the problem.

In Europe and North America, measures taken to slow the spread of COVID-19 lead to decreased productivity in ports. Adverse weather events and industrial action in Australia lead to port congestion here.

The global container movement system couldn’t keep up. Empty containers piled up at ports in Australia and New Zealand and scarce in Kolkata, forcing manufacturers to truck their goods to Mumbai, where there are more containers.

Since the cargo was not moving, the shipping lines removed capacity by blanking sailings to lower their operating costs and shipping rates rose to extraordinary levels.

Where to from here?

Now the long peak season of 2020 is over, what will happen now is the question many are asking. Will consumer spending patterns shift, or will the US stimulus keeps things going for a while longer?

A.P. Moller-Maersk A/S Chief Executive Officer Soren Skou expects “the current exceptional situation” of surging demand, supply chain bottlenecks and equipment shortages to continue until mid-year “and normalise thereafter.”

According to India’s The Economic Times, shares in Maersk dipped by 10% in February signalling freight rates are close to peaking. With capacity fully deployed and new containers coming into service, industry observers expect volatile spot rates to stabilise and bottlenecks to ease by the end of the first half.

From every ‘industry observer,’ there is a different observation. However, the general trend is that rates will remain high for some time to come. Then the market will become more stable and predictable by mid-year with fewer bottlenecks and less spikey spot rates. As capacity is added, sailings will come back into schedule, and delays will be fewer as volatility dissipates. As conditions settle, carriers will be more willing to negotiate contract rates, albeit at higher rates than before the crisis – just in time for Peak Season 2021.

______________________________________________

We know it’s a frustrating time to be an importer or exporter in Australia. The global shipping delays are causing headaches across the board. To the extent that we can, we are negotiating alternative sources of sea freight space. If we can help solve a container freight movement for you, please contact our team on 1300 651 888.

Sources: