The pandemic has created uncertainty across every aspect of the worldwide shipping industry – unprecedented congestion, delays and unfeasible global freight rates.

Australia is no exception. The country continues to battle against some of the most challenging market conditions we have ever faced, with few signs of normality returning soon.

How it began

When COVID 19 emerged in early 2020, and the Chinese Government closed factories, demand on most trade lanes collapsed as the reality of the pandemic struck the world, shipping lines responded by cancelling sailings. The reduced capacity meant freight rates remained relatively stable in the first half of last year.

As soon as the lockdowns in China eased, demand for shipping bounced as consumers set up home offices, redecorating and generally drowning their sorrows in retail therapy. By the middle of 2020, e-commerce was booming, the demand for shipping was surging, and so was the cost.

Constrained capacity and rising freight prices

The speed that consumption rebounded towards the end of last year and not an overall increase in demand did the real damage. Demand for shipping rose 88 per cent in November 2020 alone but overall has remained relatively steady since 2019. The main problem is capacity. Congestion has significantly impacted sea freight capacity, with thousands of containers stranded on land and at sea.

Congestion at ports and transhipment hubs led to long delays. Delays at Port Botany blew out to 14 days last year.

These delays threw shipping schedules out of cycle. For example, there are 13 sailings scheduled each quarter, but the line blanks three to get schedules under control. Three fewer sailings per quarter reduce the available space by 3 x 5000 TEU ships. Multiplied across the globe, and combined with other factors such as the Suez blockage and Covid outbreaks at ports in China, experts estimate that global capacity is down by more than 10%.

Shippers struggled to secure bookings and experienced more rolled cargo, and carriers increased their rates monthly and added surcharges in response to increased demand.

Shippers struggled to secure bookings and experienced more rolled cargo, and carriers increased their rates monthly and added surcharges in response to increased demand.

The sudden and extreme drop in air cargo capacity also caused air freight prices to spike to unprecedented highs.

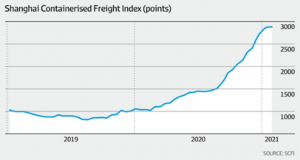

According to the Freightos Baltic Global Container Freight Index, the cost of sending one TEU surged by around 300% since February 2020. The Shanghai Containerised Freight Index hit a record this year. The cost of shipping a TEU from Shanghai to Melbourne increased by over 250%.

With no sign of a slow-down in demand and the expectation of ongoing capacity constraints, global freight rates relief in the short term seems unlikely.

Global container shortage

The import surge has thrown the world’s container stock out of sync. For places like Australia that import more than they export, the extra COVID-19-related imports have resulted in a build-up of empty containers. This imbalance has exacerbated an acute shortage of boxes in China.

NSW Ports data shows that for every 100 boxes imported, we export 100. By July last year, we were exporting 83 boxes for every 100 imported. As each month passes, empty container parks have become fuller, causing long delays and extra costs up and down the supply chain.

Container parks are at capacity. With no space to de-hire empties, ECPs redirect them, further increasing costs to the importer.

Berths for sweeper vessels are all but unavailable. With more containers coming in, there’s less room for the empties going out.

There are approximately 50,000 empty containers stuck in Australia, around 35,000 containers in South America, 150,000 in the United States, plus containers are stuck onboard vessels at anchor in Los Angeles and Long Beach.

It is also worth noting that the container shortage is forcing shipping lines to favour tradelanes that allow them to maximise revenue, e.g., China>USA, China>Erurope, at the expense of less profitable markets, e.g. China>Australian / NZ, putting more pressure on space a rates’

The shortage of appropriate equipment also creates a reluctance among shipping lines to accept bookings into some of Australia’s export markets for fear the containers can’t be retrieved.

Industrial action

Australia has also experienced a protracted wave of industrial action. Trade unions and ports have been negotiating new enterprise agreements. The ongoing disputation has created further uncertainty across entire supply chains.

Stevedore charges

The ACCC’s annual report on stevedoring, published last November, found terminal access charges increased 52% in the 2020 financial year.

The report concludes that due to the superior negotiating power of the shipping lines, stevedores are earning 30% less per container lift than ten years ago. They have used terminal access charges to make up the shortfall.

Where to now?

When are the experts predicting global freight rates and the imbalance of empty containers to settle down? Most expect it to last at least the rest of this year, with some predicting spot rates to drop in 2022. More than likely, it will be a volatile couple of years to come.

At Magellan, we’re encouraging clients to consider using LCL shipping and Air/Sea solutions – a combination of fast air freight forwarder and affordable sea freight rates as alternatives to full-container shipping where possible.

Several mainstream media outlets have published their analyses of the situation. ABC’s explainer is excellent.

At Magellan Logistics, we provide a variety of services including digital freight forwarders, importing from China to Australia. Contact us today for more information.